Your Taxes Update

Two interesting articles today in Tax Notes. First is by Lee Sheppard, scourge of tax planners everywhere. In yet another summary of the current mess concerning the examination of taxation of carried interest in private equity funds (bottom line: should what walks, talks and looks like comp be taxed as such, rather than as capital gains?), Ms. Sheppard focuses on a smaller technique used in funds - the management fee conversion. In this technique, managers of funds waive their entitlement to management fees (which are taxed at 35%) in exchange for a speculative interest in future profits of the funds they manage (which they hope will be taxed (1) later, and (2) at 15%). She ackowledges that the technique (if not some of its more aggressive offshoots) should work under current law, but then argues that service partners be "booted ... out of Subchpater K" and treated as any other service provider to an entity under Section 83. This would be the simplest answer to the carried interest debate as well, but would require an enormous change to current law governing partnerships. In any event, Ms. Sheppard rightly points out that the issue "has legs" in Washington. More wait and see. My client alert isn't stale yet!!

Second, and much more interesting (and relevant to this blog), is a piece, again in Tax Notes, so I can't link, regarding the potential taxation to Queens' own Matt Murphy who caught Barry Bonds's 756th home run ball. In 1998, the IRS (stupidly) came out and noted that the person who recovered McGwire's historic home run ball would be subject to gift tax if he returned it to McGwire (the IRS quickly reversed its position). Similalry, there has been talk recently as to whether Mr. Murphy, even if he decides to keep and not sell the ball should be subject to tax on an "accretion to wealth" concept. Typically, taxation applies only to "realized income", but catching a home run ball is, in many tax practitioner's view, akin to walking through Central Park and stumbling upon a Monet. Seems the IRS is smartly staying out of this one. For now (note to Mr. Murphy - make sure you file your taxes on time and don't take any silly deductions - wouldn't want to get audited.

Your Baseball Update

I watched the end of the Sox 3-0 win over the D-Rays last night. I had mixed emotions because I have James Shields in my "expensive" fantasy league and was hoping for a win (I'm in a dogfight right now), but obviously was rooting for the Sox who really needed a solid win to right the ship. Best of both worlds, I guess - good outing by Shields and a solid win for the Sox. What I noticed: (1) Papelbon looked nasty. He seemed to overthrow on the 1-2 pitch to Upton, but came back and got Pena on a weak grounder to second to end it; (2) Totally anecdotal, but Lowell seems to have a lot of big hits for the Sox; and (3) Tampa will never be close to good until it finds arms who can throw strikes in the pen. They've got some hard throwers (Balfour, et. al.), but they get themselves into trouble unnecessarily. I should know having had four separate Rays starters on my team at some point this year (Shields, Kazmir, Hammel and Sonnanstine).

Some good links:

Over the Monster, and read down for a "relax, keep breathing" (TM Dre) review of the situation viz a viz the Yanks.

Red Sox Fan in Pinstripe Territory. Good take on the ridiculousness at Yankee stadium too. Damn O's couldn't close the door.

Your Death Update

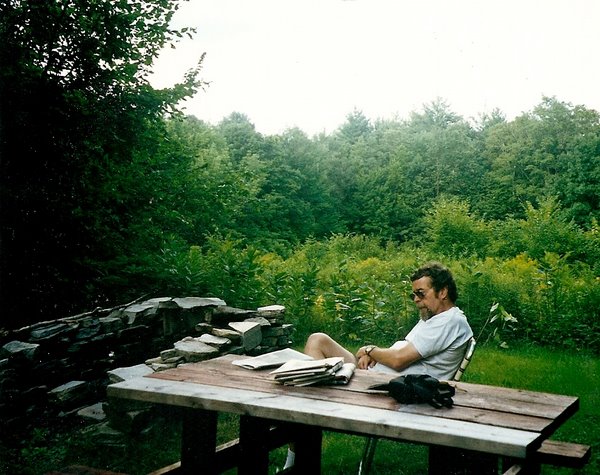

First, I feel guilty for starting this blog two weeks ago and not mentioning one thing about dad since then. I will try to make sure that one entry in the death update each day is a remembrance or something about how I am feeling. Don't worry, it will come after your death and taxes updates for the day.

September 22, 2006 was when he passed away. I'll tell the whole story some time, but I was there when it happened. In any event, the anniversary (what's the word for a bad anniversary? sadiversary?) is coming up in 5 weeks or so, and I feel like I used to feel when I had to get up in class and speak, or had to do something I really didn't want to do - like time is pulling me forward, dragging me, kicking and screaming. I feel resistance in my body as I don't even want to come close to a date, or an event, or any thing really, that will force me to remember that day and how I felt and how everyone felt and HOW MUCH IT FUCKING SUCKED and still does. Why I still won't watch Field of Dreams. Anyway, that's how I feel today.

Also, Brooke Astor finally died. I guess she was a NY big shot. Whatever. Reminds me of an interview sketch from college - Abe Vigoda was the guest - the host was surprised to see him and said "are you sure you're not dead. I could have sworn you were dead". All the legal wrangling around Ms. Astor's will - shit - I thought that was post-mortem. OH well. she was 105 and did some serious good for a boatload of people, including many in my 'hood. The obit is here.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment