The Bills Update

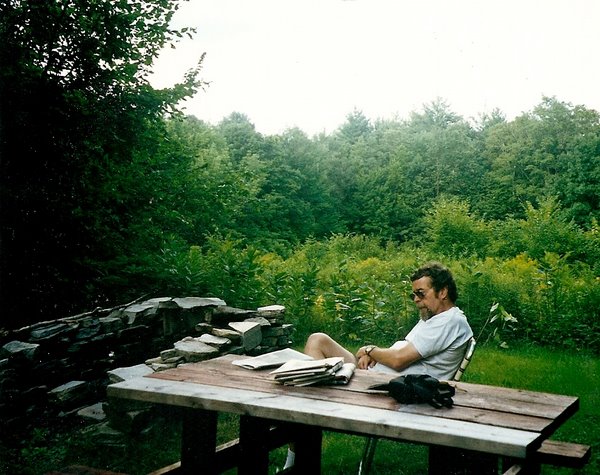

YES. This guy is doing the Bills-Dolphins game this weekend:

Since Eagle/Wilcots are off this week, I guess that makes them officially the Z-team of CBS broadcasters. And if I had an HDTV, I could watch the game in hi-def.

Seeing that Gus is doing the game made me wonder if I would remember differently some of the famous and infamous moments in Bills history if he had been calling the games.

Wide Right: Norwood lines up for the kick. This is at the EDGE of Norwood's distance. Marv Levy is putting his faith in the young kicker out of JAMES MADISON. It's all on the line for the Bills. The snap, the hold is down. The Kick is UP... And... It's NO GOOD!! NO GOOD!! WIDE RIGHT! And TIME HAS EXPIRED! The GIANTS WIN! Somehow the Giants are able to carry Parcells OFF THE FIELD. OH MY, Scott Norwood will carry this moment TO HIS GRAVE. SLEEP TIGHT SCOTTY! HA HAAAAAA"

Frank Reich comeback against Houston in '93: "Forget about the Nazis, here in Buffalo it's the RISE OF THE FOURTH REICH as the Bills unleash the stormtroopers aganist the Oilers. Ha haaaaaaa." "Christie lines up for the winning kick. And it's GOOOOOOOD!!!!! Christie drives a STAKE through the hearts of the Oilers as the Bills win in DRAMATIC FASHION!! DIE NOSFERATU!!!

(sidenote: this game was NOT televised locally in Buffalo because the Bills actually did not sell out the game. A playoff game. I had to listen to freaking Van Miller on the radio).

Music City Miracle: The kick is short to Neal. Neal hands off to Wycheck.. and Oh, Wycheck HEAVES it to Andre Dyson, and Dyson is RUNNING. OH NO, IT's A CLEAR PATH TO PAYDIRT. OH NO. NOBODY's GOING TO CATCH HIM. And Dyson is IN. And it's PANDEMONIUM in Tennessee. Rob Johnson can't bear to look. Wade Phillips is STUNNNED as the Titans RIP THE BEATING HEARTS out of the Bills's chests. KALI MA, they'll SEE YOU IN HELL!!!!!"

No, that still would have sucked.

Last Second Jason Elam Field Goal: Oh wait, he actually did call this game:

I'm surprised he didn't refer to it as a "CHINESE FIRE DRILL!!!!"

Anyway, it's always a "SPECIAL GAME" when Gus is announcing.

-- As for actual analysis? Happy that Losman is starting. He's like Brett Favre, except without the joy. Or much of the talent.

For actual analysis, go to Bflo Blog for the Tailgate.

Goose's Roost has an interesting post on Jim Kelly and Jack Kemp being potential white knights in a future sale of the Bills.

That's it. My prediction? (not that it matters): Bills 21, Miami 17

The Taxes Update

-- The House today passed a bill providing for a one-year AMT patch and extending a bunch of popular tax deductions, the cost of which is offset by changing the tax treatment of carried interest in private equity funds and eliminating offshore deferrals of compensation (where the payor is tax-indifferent). The Senate has not introduced a bill addressing AMT relief and apparently won't until December.

Which really is an abdication of Congresional responsibility. You see, even if a bill is introduced in December, debated, passed, harmonized with the House and signed by Bush, it won't be in time for the IRS to make changes to tax forms necessary to allow taxpayers to file returns correctly. This means that millions of taxpayers will end up overpaying their taxes and seeking refunds later (because they will be forced to file based on the law that is in effect now which sucks millions of taxpayers into the AMT. I think the House is probably more to blame for waiting so long to introduce a bill when EVERYONE KNEW ABOUT THE ISSUE.

-- One other interesting story from last week that is semi-sports related: The IRS has announced an initiative targeting foreign golfers, tennis players and entertainers who work in the U.S. That's right - Roger Federer is a tax cheat* The concern is that foreign entertainers are not paying their "fair share" of withholding taxes on income earned in the U.S. (there is a 30% withholding tax applicable to nonresident aliens performing services within the United States). The focus apparently is on the structures through which entertainers earn money within the United States and making sure that withholding takes place somewhere along the chain. This is all part of closing the tax gap.

*May not actually be a tax cheat, but this commercial is ridiculous:

And what the hell is Henry saying? "I nevuh fthk about ystdy".... Thanks Thierry, er Terry. Go back to playing with your ball.

No Death Update right now. Maybe later.